Periods and Financial Years¶

Note

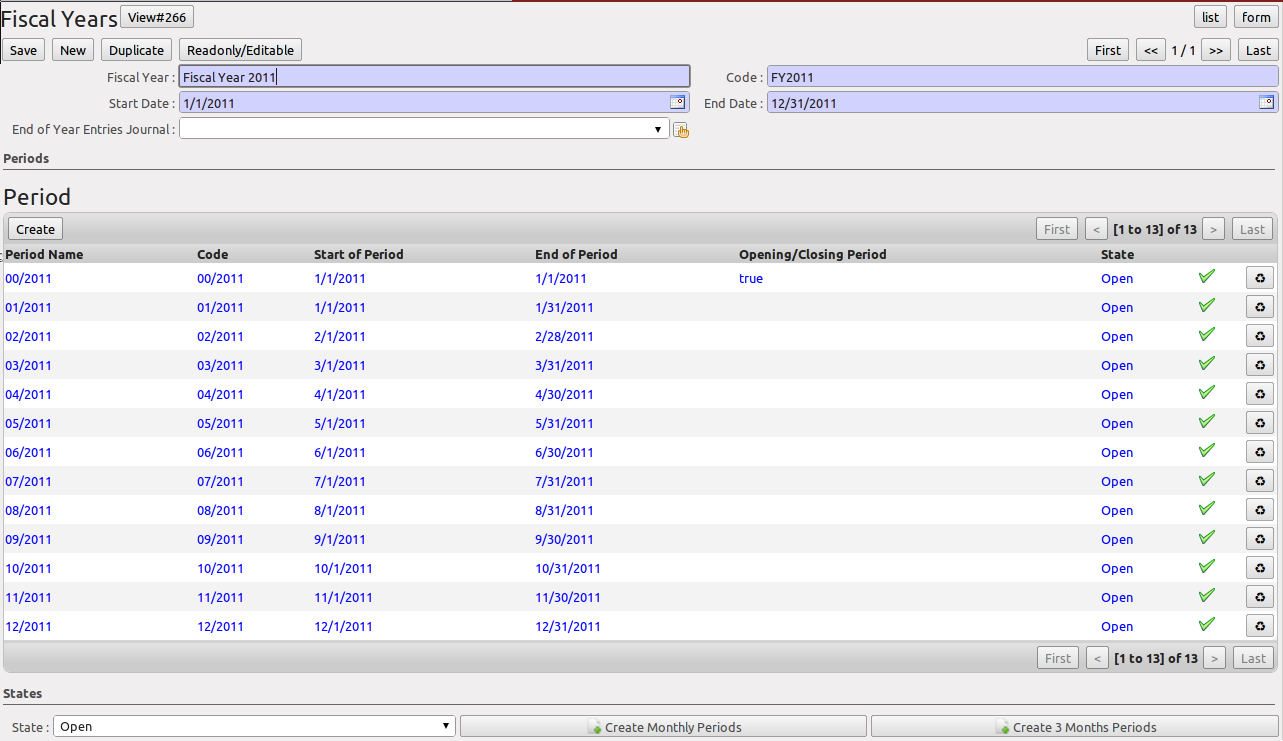

Periods and Fiscal Years

A fiscal year (or financial year) corresponds to twelve months for a company. In many countries, the fiscal year corresponds to a calendar year. That may not be the case in other countries.

The financial year can be divided into monthly or three-monthly accounting periods (when you have a quarterly declaration).

OpenERP’s management of the fiscal year is flexible enough to enable you to work on several years at the same time. This gives you several advantages, such as the possibility to create three-year budgets.

Defining a Period or a Financial Year¶

To define your fiscal year, use the menu Accounting ‣ Configuration ‣ Financial Accounting ‣ Periods ‣ Fiscal Year. You can create several years in advance to define long-term budgets.

First enter the date of the first day and the last day of your fiscal year. Then, to create the periods, click one of the two buttons at the bottom depending on whether you want to create twelve 1-month or four 3-months periods:

- Create Monthly Periods ,

- Create 3 Months Periods .

OpenERP automatically creates an opening period to allow you to post your outstanding balances from the previous fiscal year. Notice the Opening/Closing Period checkbox for such a period.

Closing a Period¶

To close a financial period, for example when a tax declaration has been made, go to the menu Accounting‣ Configuration ‣ Financial Accounting ‣ Periods ‣ Periods. Click the green arrow to close the period for which you want no more entries to be posted.

Tip

Opening Closed Periods

The system administrator can re-open a period should a period have been closed by mistake.

When a period is closed, you can no longer create or modify any transactions in that period. Closing a period is not obligatory, and you could easily leave periods open.

To close an accounting period you can also use the menu Accounting‣ Periodical Processing ‣ End of Period ‣ Close a Period.